Investments in improved agricultural practices will be essential to address the intertwined challenges of climate change mitigation, adaptation and food security. Private and public finance can play an important role in creating incentives for the reduction of emissions from the agricultural sector and increased resilience to climate change. The level and distribution of climate finance among countries will affect agricultural development opportunities and social justice among countries.

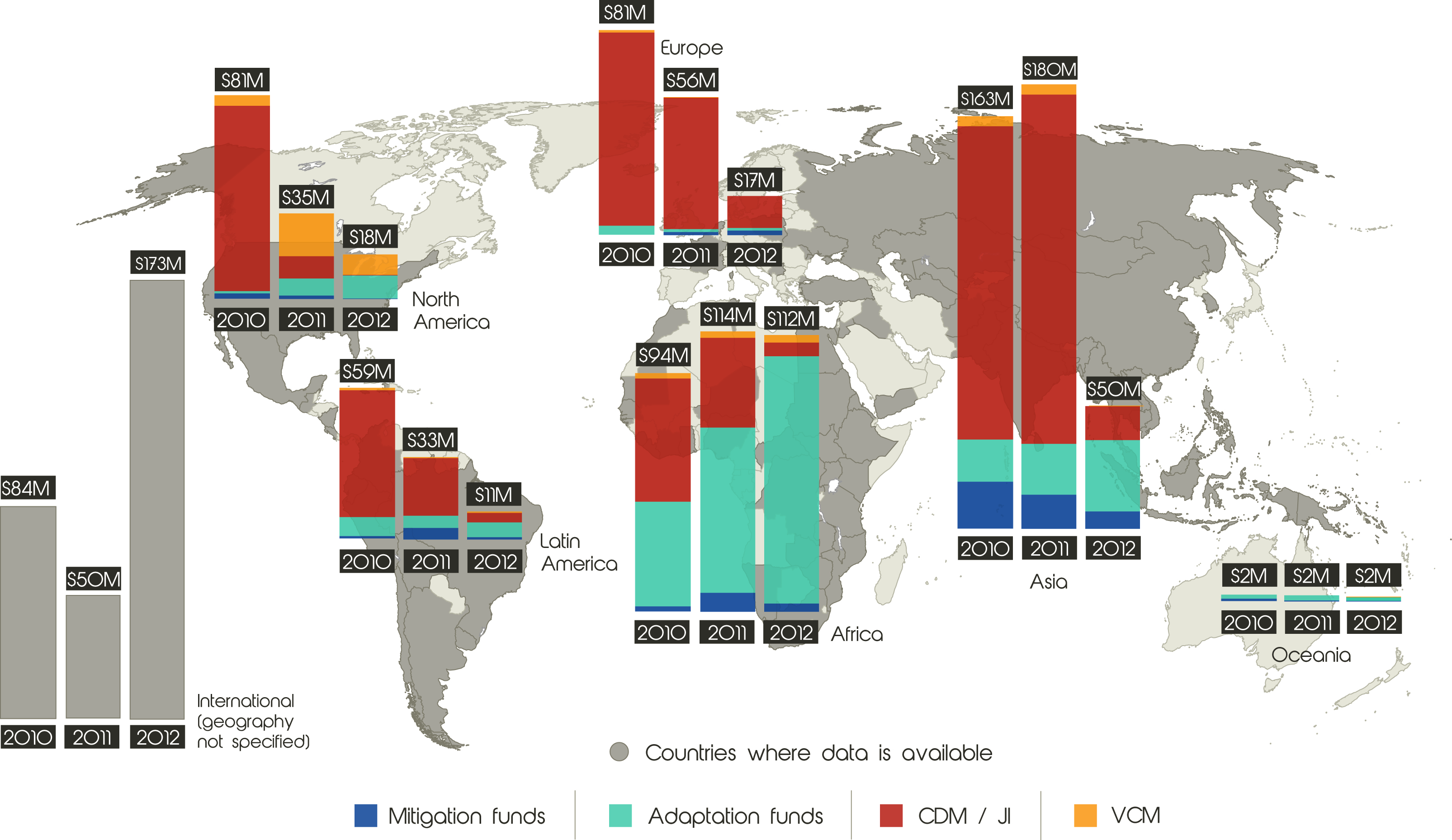

The years 2010 to 2012 were pivotal years for climate finance because of a drop in carbon prices and developed country commitments to new “fast-start” finance for adaptation and mitigation established under the 2009 Copenhagen Accord. The purpose of this detailed research was to analyze the deployment of agricultural climate finance by geographic area over this formative period of 2010-2012, to gain an early understanding of the sources of funds and how they are being distributed.

Under the 2009 Copenhagen Accord, developed countries agreed to provide USD 30 billion “fast start finance” during 2010-2012, with balanced allocation between adaptation and mitigation, prioritizing the most vulnerable and least developed countries. A recent report of the World Resources Institute (WRI) concluded that between 2010 and 2012, USD 35 billion of fast start finance was pledged, exceeding the original commitment. The majority of fast start finance to date has been destined for mitigation in industry and energy sectors. The main conclusion was that climate finance for agriculture was below what the mitigation potential would justify.

Of the USD 35 billion fast start finance disbursed, agriculture accounted for USD 0.75 billion, equivalent to 2.1 %. This is modest given the contribution of agriculture to global greenhouse gas (GHG) emissions, estimated at around 14 to 24 %.

Emerging economies such as China, South Africa, Brazil, Uzbekistan and Mexico were the main beneficiaries from carbon-market finance for mitigation, while Sub-Saharan Africa was the main beneficiary when finance shifted to adaptation.

The bulk of mitigation finance in 2010-2012 from carbon markets went to reducing N2O emissions from fertilizer production, followed by using agricultural residues as a biomass energy source, or as a source of biogas and reduced tillage projects.

Ethiopia was the single largest recipient of dedicated adaptation finance (USD 25 million in 2010, 2011 and 2012).

The full report can be downloaded from the Climate Focus web-site. The project was managed by Jelmer Hoogzaad, at the time staff member and shareholder of Climate Focus.

Client: CGIAR

Partners: Climate Focus, Visilio Design

2013